.jpeg?width=800&name=AdobeStock_249724033%20(1).jpeg)

CLIENT PROFILE

The client is a leading medical supplier of various products and services in the rehabilitation space. The Company also provides maintenance and repair services for the products it supplies.

BUSINESS CHALLENGE

Patients had to wait extremely long cycle times from the time they first engaged our client until they received their products. There are a number of reasons for this long order cycle time, including supply chain and manufacturing dependencies, but a major factor was the ongoing, and highly manual, insurance claims process. Changes to the patient’s insurance policy information, including provider, address, or plan coverage, caused significant delays in the ordering process, and often required the company to re-start the process when the patient’s insurance information changed.

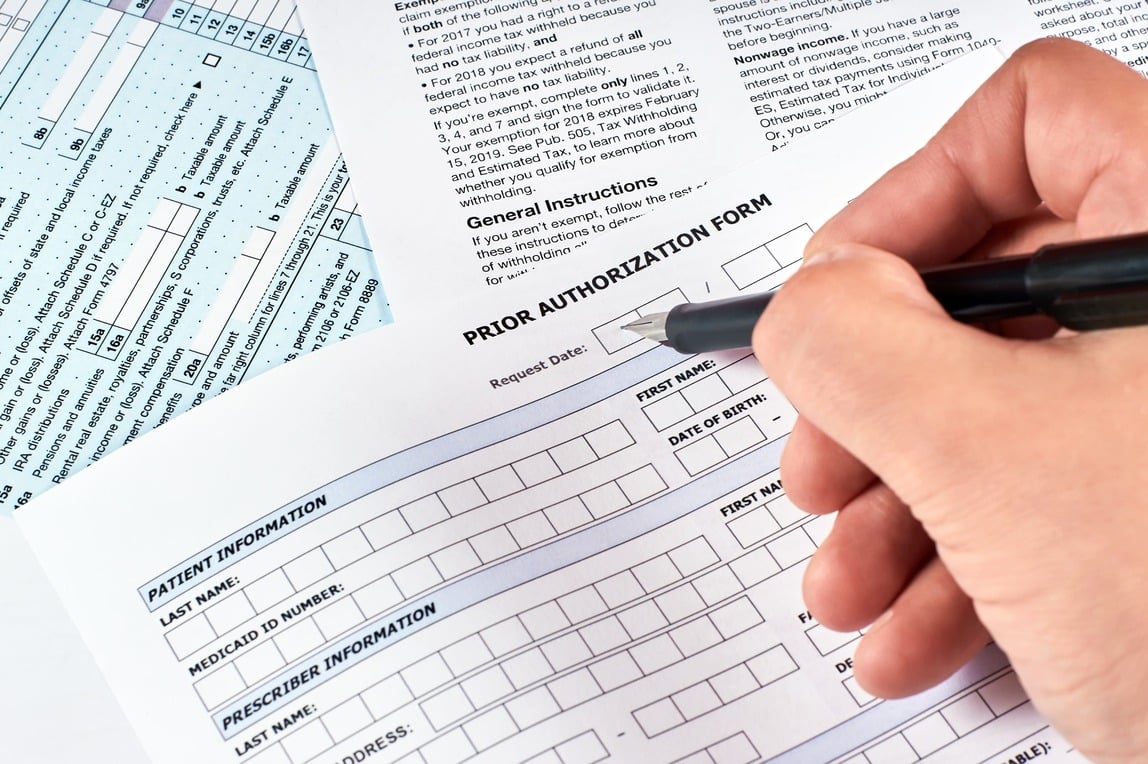

In addition, keeping up with the rules of different insurance plans was difficult, time consuming and prone to error. Specifically, for Prior Authorization, the number of days it takes for insurance companies to respond varies extensively, requiring company employees to repeatedly check on the status of a large number of requests. The manual and repetitive nature of this process can lead to a delay in registering a payer’s approval/denial which delays the delivery of the products.

The longer the order takes to complete, the more likely changes to insurance coverages would occur (e.g., provider, deductible, coverage, out of pocket amount, etc.).

As a result, the company had to perform multiple insurance verifications at various stages throughout the ordering process in order to ensure that a patient’s coverage is current throughout the whole process, up to the time of their delivery.

The client understood that shortening the life cycle of the order would give them a significant competitive advantage, and was looking to decrease cycle times significantly, while at the same time, reducing the impact of insurance plan changes and decreasing the amount of manual data entry and follow-up required.

SOLUTION

Robotic Process Automation

The client consulted with Auxis to determine how to reduce the order cycle for its customers, and also improve the accuracy of the ordering process. Together, it was determined that the client needed to focus on the steps in the process that required the most manual effort, which would frequently contribute to the delays. Implementing Robotic Process Automation (RPA) was an ideal solution to increase efficiency in the insurance verification, prior authorization submission, and prior authorization follow-up activities being performed manually. The strategy was to automate the activities within these processes that did not require any analysis and decision making on the part of the company’s staff.

Healthcare Provider Company

Auxis worked with the client to deploy several unattended robots designed to use the information within the customer’s proprietary order management system to determine whether the order can be worked by the “bot”, or reassigned to a person for further review/analysis. Additionally, the bots would log in to the web portals of various payers (the insurance companies) to review information pertinent to the customer’s coverage and order status. The key processes automated included:

1. Insurance Verification

The bots pull information out of a work queue within the client’s patient and order management databases and use that information to review the customer’s insurance policy and coverage details from the provider’s portal. Based on a series of pre-determined validation rules, the bot decides how to proceed with the order, and updates the customer and order management system accordingly. Below are a few examples of tasks the bot performs to advance orders to the next stage in the process:

The bots pull information out of a work queue within the client’s patient and order management databases and use that information to review the customer’s insurance policy and coverage details from the provider’s portal. Based on a series of pre-determined validation rules, the bot decides how to proceed with the order, and updates the customer and order management system accordingly. Below are a few examples of tasks the bot performs to advance orders to the next stage in the process:

- Validate key customer details including first name, last name, DOB

- Validate policy details, including that it is active. Confirm that customer does not have any other existing conditions or other claims that might impact coverage

- Check the deductible amount, out of pocket maximum and other details that might impact the amount that the customer may be required to pay

- Add order notes detailing work that the bot performed

- Reassign the order for review by a person if certain validation criteria are not met.

2. Prior Authorization Submission

After the initial insurance verification step is complete, the bots collect all documentation from the customer’s physician to request pre-authorization from the insurance company, in advance of ordering the device.

After the initial insurance verification step is complete, the bots collect all documentation from the customer’s physician to request pre-authorization from the insurance company, in advance of ordering the device.

Below are a few examples of tasks the bot performs to advance orders to the next stage in the process:

- Pulls additional details for each order

- Populates needed details in the web portal

- Uploads required documentation and submit the prior authorization request

- Adds order notes detailing work that the bot performed

3. Prior Authorization Follow-up

A key step in the order management process is to continuously follow-up with the payer to check whether a coverage decision has been made. The ability to review responses in a timely manner has a direct impact on the duration of the end-to-end process. Beginning three days after the initial prior authorization had been submitted, the bot logs into the insurance provider’s web portal, to check for a response that may be approved, partially approved or denied. The bot continues to check daily until a response is provided by the payer.

Prior to the RPA implementation, the client had dozens of employees manually checking the status of 300 orders per day in the web portals of the three highest volume insurance providers. After initially checking on a prior authorization three days after submission, employees could only perform follow ups every 3 – 5 days, creating unnecessary delays in the order lifecycle, which in cases extended to several days before registering a decision (as many as 10).

Prior to the RPA implementation, the client had dozens of employees manually checking the status of 300 orders per day in the web portals of the three highest volume insurance providers. After initially checking on a prior authorization three days after submission, employees could only perform follow ups every 3 – 5 days, creating unnecessary delays in the order lifecycle, which in cases extended to several days before registering a decision (as many as 10).

A major advantage of using RPA to automate these processes is that the company can perform prior authorization follow-up much more frequently. After the initial check, the bot can follow up on each request once per daily. This ensures that as soon as a response is received, it can be acted on, therefore decreasing the overall duration of the end to end process.

.jpg?width=770&name=luis-melendez-Pd4lRfKo16U-unsplash%20(1).jpg)

RESULTS

The RPA implementation has enabled the client to significantly reduce the average time to deliver equipment to patients, positioning the organization ahead of its competitors while increasing customer satisfaction. The client has determined that it has achieved significant measurable improvements in verification and prior-authorization process execution and time to complete orders, such as:![]() Insurance verification cadence

Insurance verification cadence

- Since verification is now automated, the client can perform the process more often, reducing the possibility of surprise changes to insurance plans, which could stall or kill orders.

![]() Increase in Prior Authorization Follow-ups

Increase in Prior Authorization Follow-ups

- Bots perform the prior authorization daily (including weekends), rather than once every 3 – 5 days (an improvement of up to 7x the manual process). The company is now aware of responses from payers the day they happen, expediting the shipping of products.

![]() Reduction of order cycle time

Reduction of order cycle time

- These process improvements have helped to reduce the order cycle time over 20% so far. We expect that the remaining 5-10 day reduction will be accomplished through additional automation. This is a valuable differentiator in a market serving patients who rely on access to these products for their daily lifestyle.

This has also improved the company’s speed to revenue, reducing the time between order and delivery, and therefore billing the payer. Decreasing the average days of an order also reduces the risk of patients switching to new insurance providers, which can significantly delay product delivery and billing by requiring a restart of the whole approval process.

RPA has also helped the client make its workforce more efficient, proactive, and less prone to make costly mistakes performing these manual tasks. Some measurable improvements include:

![]() Reduced human error

Reduced human error

- The bots execute tasks according to defined and programmed rules and therefore do not make mistakes (they do not make typos or hit the wrong buttons, and do not feel rushed to get their work done). This was a huge relief to a large back office, responsible for a high volume of tasks, many of which required no subjective review or analysis.

- Turnover is expected to decrease, as people’s jobs improved through the reduction of tedious, manual work as well as the reduction in the stress levels felt by the employees to manage their workload.

![]() Employees Shifted to More Proactive, High-Level Problem Solving

Employees Shifted to More Proactive, High-Level Problem Solving

- Having the bot take on the “easy” tasks frees up the employees to focus only on the nuanced orders requiring a more detailed review.

cropped.png)

%20(1).png)